OMV won lawsuit against Equinor

Northeast of Gullfaks lies the relatively small oil and gas field Gimle, with reservoir volumes around one seventy-seventh the size of Gullfaks. Gimle consists of three subsea wells and began production in 2005. Oil from the field is transported via pipeline to Gullfaks C, where it is processed and sent onward to market. The Gullfaks license is responsible for accounting how much oil originates from Gimle.

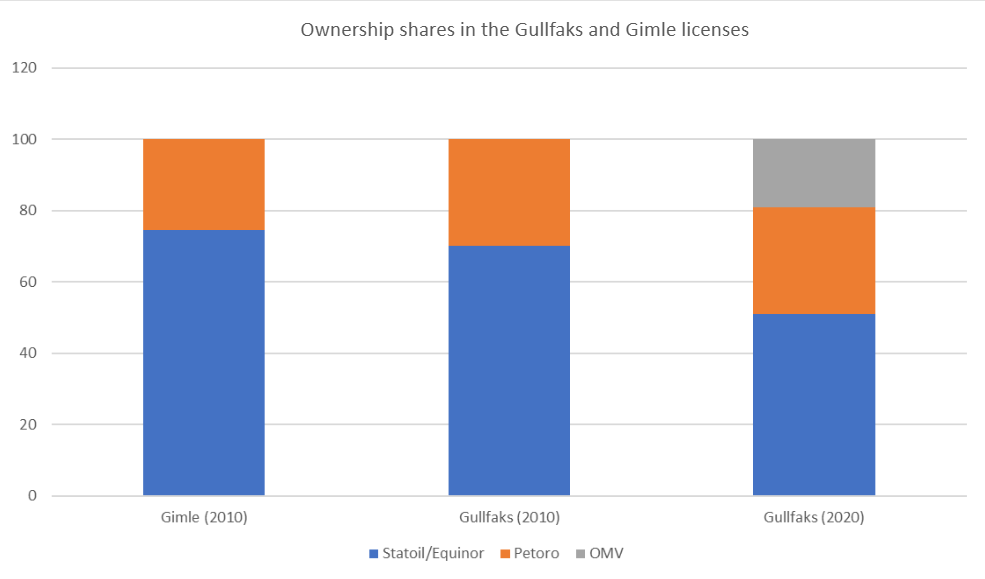

In 2010, an error occurred in these calculations. Gullfaks was credited with a portion of Gimle’s oil production. In other words, oil from Gimle was registered as if it had come from Gullfaks. At the time, the consequences of this mistake were minimal—virtually negligible—because the license structures of Gullfaks and Gimle were nearly identical. Gullfaks was operated by Statoil (70 percent) and Petoro (30 percent). Gimle’s ownership was 74.6 percent Statoil and 25.3 percent Petoro. The miscalculation meant that Petoro received a small financial gain at Statoil’s expense.

In 2013, however, Austrian company OMV acquired a 19 percent stake in Gullfaks. OMV’s entry made the 2010 error more consequential for the companies involved, as license compositions had diverged. The continued misregistration of Gimle oil as Gullfaks oil meant OMV, a stakeholder in Gullfaks but not in Gimle, profited from the mistake. When the error was discovered ten years later in 2020, Equinor corrected it retroactively.[REMOVE]Fotnote: Dommersnes, T. D. (8. juli 2023). Equinor tapte rettssak mot OMV – må ut med rundt 70 millioner. Stavanger Aftenblad. https://www.aftenbladet.no/okonomi/i/mQE844/equinor-tapte-rettssak-mot-omv-maa-ut-med-rundt-70-millioner

The Gimle oil that had been mistakenly credited to Gullfaks over the previous decade was reallocated to the Gimle license. As a result, Gimle license holders were compensated for lost income throughout the entire miscalculation period (2010–2020). This reallocation came at a significant cost to OMV, which only participated in the Gullfaks license. The correction meant OMV lost rights to 86,000 barrels of oil, worth nearly NOK 70 million. The Austrian oil company contested this and took legal action to stop the reallocation.

OMV based its case on two main points: first, it was not part of the Gullfaks license when the error occurred in 2010.[REMOVE]Fotnote: Gulating lagmannsrett. (2022). Dom: LG-2022-130795. Lovdata. Gulating lagmannsrett – Dom: LG-2022-130795 – Lovdata OMV had entered the Gullfaks partnership in good faith, unaware that the field had been over-credited with oil. Second, OMV argued that the Gimle license’s claim should be considered a financial claim (a “receivable”), which is normally subject to a three-year statute of limitations.[REMOVE]Fotnote: Lov om foreldelse av fordringer (foreldelsesloven) § 2. On that basis, they contended that the claim had expired.

Receivable or restoration of ownership rights?

The key question in the Court of Appeal was whether Gimle’s claim constituted a receivable or whether it was a demand to correct ownership imbalances. A receivable is a claim for the transfer of a defined value—like saying “Kari owes Per NOK 100.” That differs from claims to restore ownership. An example of the latter might be clarifying the ownership split in a production license, or a statement such as “Kari owns 60 percent of the house she shares with Per.”

If Gimle’s claim were deemed to concern ownership rights, the license would be entitled to recover lost income for the entire 2010–2020 period.

Equinor based part of its argument on the “Statfjord ruling” from 2010. That case also dealt with the correction of misallocated oil volumes, due to a technical measurement error. A malfunctioning instrument on Statfjord C had generated incorrect flow data regarding how much oil came from other fields. In that case, the Court of Appeal concluded that the claim was grounded in ownership rights in the production licenses, and was therefore not a receivable. Equinor argued that the same logic should apply to Gimle.

The court disagreed. As part of the agreement between the Gullfaks and Gimle licenses—regarding the transport and storage of Gimle oil on Gullfaks C—it had been established that settlements between licenses could be made through either oil or cash transfers. The court found that Gimle’s claim was part of a compensation arrangement that was commercially motivated and individually negotiated. It was therefore not connected to the underlying ownership of the oil resources. The Gimle claim was ruled to be a receivable and had therefore expired.

OMV prevailed in both Sør-Rogaland District Court and the Gulating Court of Appeal. The reallocation of oil from Gullfaks to Gimle was declared invalid, and the corresponding funds had to be returned to OMV. Equinor was also ordered to cover legal costs.

In December 2023, Equinor’s appeal was rejected by the Supreme Court. The judgment from the Gulating Court of Appeal is therefore final.

The 500th WellNorway’s offshore wind dream