Gullfaks Reference Price

Since 1975, oil companies have been subject to a 78 percent tax on their profits. This means the state covers 78 percent of their costs and collects 78 percent of their revenues. The tax rate for oil production (so-called “upstream activity”) is significantly higher than for most other industries.

This setup might appear to open the door to tax avoidance: if oil companies sell their crude at a discount — for instance, to a subsidiary or a refinery they have a special deal with — they could shift profits from the upstream sector (where taxes are high) to downstream operations like refining (which are taxed at the regular rate).

To close that loophole, Norway established the Petroleum Price Board in 1975, alongside the introduction of the special petroleum tax. The board determines a “norm price” — what a company could reasonably be expected to sell its oil for in an open market. When calculating taxable income, the authorities use this norm price instead of the actual sale price.

The relevant regulation puts it this way:

“The norm price shall reflect the price petroleum could have been sold for between independent parties in a free market. Independent parties are defined as buyers and sellers without shared interests that could influence the agreed price.”[REMOVE]

Fotnote: Energidepartementet. (1976). § 2 i Forskrift om fastsetting av normpriser (FOR-1976-06-25-5). Lovdata. https://lovdata.no/dokument/SF/forskrift/1976-06-25-5

Because taxable income is decoupled from actual sales prices, oil companies no longer have an incentive to underprice their oil to reduce tax liability. They benefit from selling at the highest possible price, which ensures efficient pricing in the market without encouraging tax planning.

This system has an interesting consequence: if a company manages to sell oil above the reference price, it keeps the excess profit tax-free. On the flip side, if it sells below the norm price, the shortfall is not deductible.

A separate reference price for each crude type

Norm prices are published quarterly and retroactively. Four times a year, the Petroleum Price Board releases prices covering the three previous months. These include daily reference prices for Dated Brent — the benchmark grade used in most contracts.

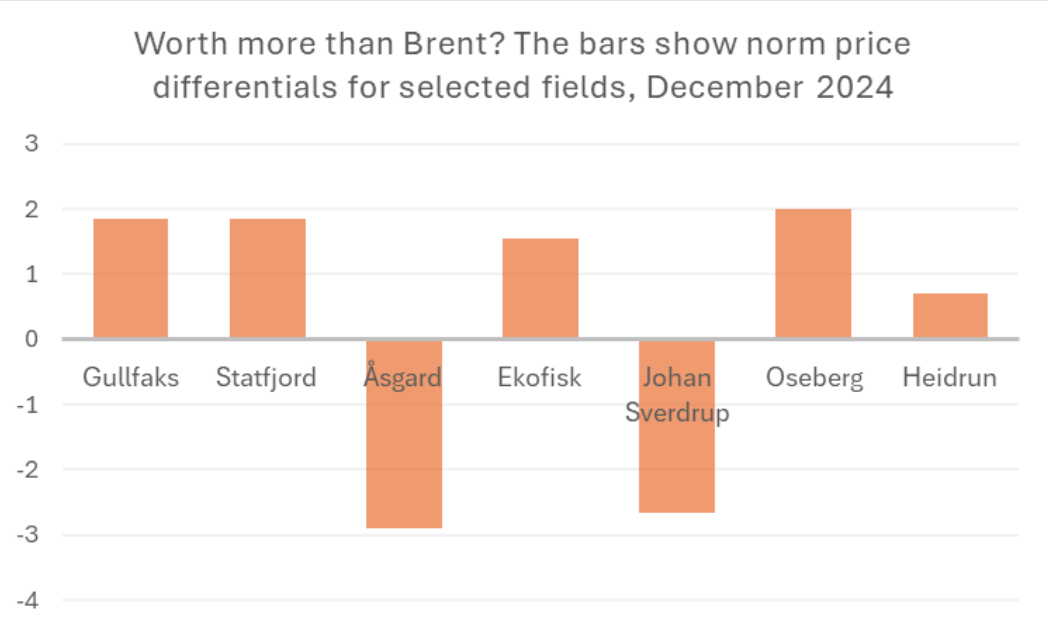

In addition, the board publishes premiums or discounts — known as differentials — for specific crude qualities. These are expressed as “dollars over or under Brent.” Oil isn’t just oil — it varies by quality, depending on factors such as sulfur content, acidity, and API gravity (a measure of whether oil is heavy or light). Since these differences affect how desirable a crude is on the market, each quality requires its own norm price. The differentials apply on a monthly basis.

In December 2024, Gullfaks had a differential of $1.85, as shown in the figure below. That means the tax calculation for oil from the Gullfaks license used the Dated Brent price on the fifth day after loading — plus an additional $1.85 per barrel.[REMOVE]Fotnote: Norwegian Ministry of Energy. (2024, December 9). Petroleum Price Board and Reference Prices. https://www.regjeringen.no/no/tema/energi/olje-og-gass/petroleumsprisradet–og-fastsetting-av-n/id661459/

In other words, tax authorities look at the Brent price on the day the cargo is expected to reach the buyer, then add the applicable Gullfaks differential for that month.

Changes over time

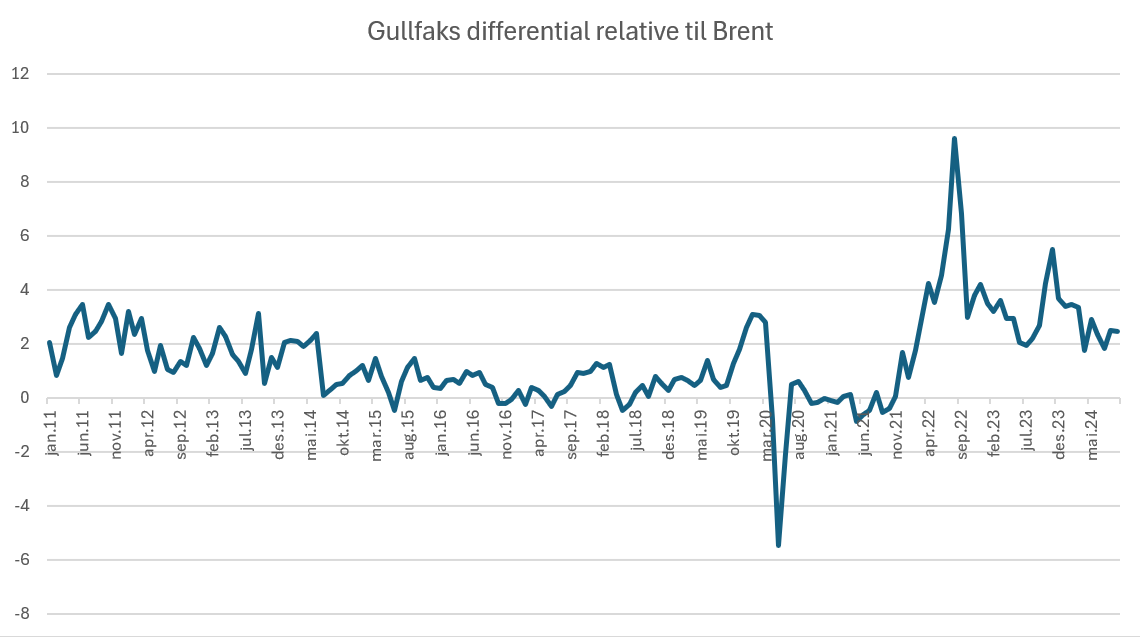

Differentials for a given crude quality aren’t static. Even if the oil’s composition remains unchanged, shifts in the market can affect how desirable a crude is. Tracking Gullfaks differentials over time reveals how the field’s oil has been valued relative to Brent.

Between 2011 and 2019, Gullfaks crude gradually moved closer to Brent in market valuation. Around the COVID-19 pandemic, there was increased volatility — and in March 2020, some historically poor deals for Gullfaks oil were recorded.

In 2022, when Russia launched its full-scale invasion of Ukraine and Europe responded with sanctions on Russian oil, the Gullfaks differential began climbing again — and has remained elevated since. The near-total disappearance of Russian crude from the European market had a strong effect on oil prices in general, but it also gave Gullfaks a significant boost in relative value.[REMOVE]Fotnote: Norwegian Ministry of Energy. (2024, December 9). Petroleum Price Board and Reference Prices. https://www.regjeringen.no/no/tema/energi/olje-og-gass/petroleumsprisradet–og-fastsetting-av-n/id661459/

That post-invasion upswing isn’t unique to Gullfaks. Other Norwegian fields — including Troll and Ekofisk — also saw increasing differentials, even though their oil types vary significantly.

In the early 2000s, much of the oil was stored at Mongstad before being shipped by tanker (often to Asia), partly due to limited refinery capacity in Europe. Today, most cargoes go directly to the buyer. In recent years, a significant portion of Gullfaks oil has gone to Preem’s refinery in Sweden and to the UK (BP). Looking further back, BP was by far the dominant buyer of Gullfaks crude.